Hamilton Informs Taxpayers of Estimated Third Quarter Tax Bill.Fatal Berkeley Township Fire Ruled Accidental.Pair From Trenton Busted in Connection to Hamilton Township Auto Thefts.64-Year-Old Woodbridge Man Charged In Seeking Sex With 14-Year-Old For Cash.Rising Junior at Steinert High School to Perform on National School of Rock AllStars Tour and Raise Funds to Support Teen Suicide Prevention.Traffic Alert County Road 539 Closed Near Allentown.Escaped Inmate In Ewing-Trenton Area Captured.Firefighters Battle 2-Alarm Warehouse Fire In Robbinsville, NJ.Fire Quickly Extinguished In East Windsor.Cocaine, Heroin, Handgun and 30 Pounds of Marijuana Seized by the Mercer County Narcotics Task Force.City of Trenton Paving Season is Well Underway.Two Brothers Sentenced To Prison For Narcotics.Toms River Woman Pleads Guilty To Vehicular Homicide.

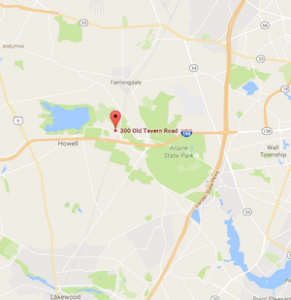

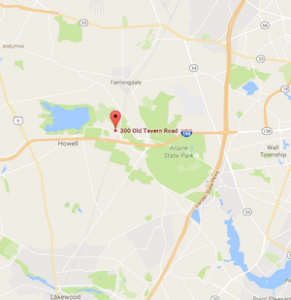

Truck Driver Injured In NJ Turnpike Crash In Robbinsville, NJ. South Broad Street In Hamilton Closed Due To Police Activity. Pipe Bombs Found In Traffic Stop In Hamilton Township Mt. Join 414 other subscribers 25 Latest Stories Merin and J Fortier Imbert of the Special Prosecutions Division in Newark.ĭefense counsel: Edward C. The government is represented by Assistant U.S. Dennehy in Newark, with the investigation leading to the sentencing. Attorney Sellinger credited special agents of the IRS-Criminal Investigations, under the direction of Acting Special Agent in Charge Tammy Tomlins, and special agents of the FBI, under the direction of Special Agent in Charge James E. In addition to the prison term, Judge Quraishi sentenced Bryce to one year of supervised release, a $50,000 fine, and ordered to pay $338,885 in restitution. As part of his plea agreement, Bryce agreed to pay full restitution of $338,885 to the IRS for tax losses resulting from false tax returns filed by Bryce for calendar years 2011 to 2016. The 2013 tax return was not true and correct: Bryce received significant income from his gambling business, and, as a result, had income substantially in excess of the amount he reported. Individual Income Tax Return, Form 1040, for the calendar year 2013 on behalf of himself and his spouse, which falsely stated that they had total income of $112,899. On July 14, 2014, Bryce filed with the IRS U.S. In 2013, Bryce operated an illegal gambling business. 20, 2022, in Trenton federal court.Īccording to documents filed in this case and statements made in court: Thompson to Count Five of an indictment charging him with subscribing to a false tax return. Steven Bryce, 52, of Howell Township, New Jersey, previously pleaded guilty before U.S.

Truck Driver Injured In NJ Turnpike Crash In Robbinsville, NJ. South Broad Street In Hamilton Closed Due To Police Activity. Pipe Bombs Found In Traffic Stop In Hamilton Township Mt. Join 414 other subscribers 25 Latest Stories Merin and J Fortier Imbert of the Special Prosecutions Division in Newark.ĭefense counsel: Edward C. The government is represented by Assistant U.S. Dennehy in Newark, with the investigation leading to the sentencing. Attorney Sellinger credited special agents of the IRS-Criminal Investigations, under the direction of Acting Special Agent in Charge Tammy Tomlins, and special agents of the FBI, under the direction of Special Agent in Charge James E. In addition to the prison term, Judge Quraishi sentenced Bryce to one year of supervised release, a $50,000 fine, and ordered to pay $338,885 in restitution. As part of his plea agreement, Bryce agreed to pay full restitution of $338,885 to the IRS for tax losses resulting from false tax returns filed by Bryce for calendar years 2011 to 2016. The 2013 tax return was not true and correct: Bryce received significant income from his gambling business, and, as a result, had income substantially in excess of the amount he reported. Individual Income Tax Return, Form 1040, for the calendar year 2013 on behalf of himself and his spouse, which falsely stated that they had total income of $112,899. On July 14, 2014, Bryce filed with the IRS U.S. In 2013, Bryce operated an illegal gambling business. 20, 2022, in Trenton federal court.Īccording to documents filed in this case and statements made in court: Thompson to Count Five of an indictment charging him with subscribing to a false tax return. Steven Bryce, 52, of Howell Township, New Jersey, previously pleaded guilty before U.S.

– A Monmouth County, New Jersey, man who ran an illegal gambling business was sentenced to 18 months in prison for filing a false tax return, U.S.

0 kommentar(er)

0 kommentar(er)